In India, the widely used Unified Payments Interface (UPI) digital payment system enables users to transfer money instantly between banks using their smartphones. UPI transactions processed an astonishing 8.7 billion in March 2023, which is a testimony to the country’s growing acceptance.

Indians now pay in a simpler, faster and more secure way than ever before. With the help of UPI, users no longer need to carry cash or go to the bank to transfer money. They can easily send and receive money, pay bills and even shop online and offline using their mobile phones.

UPI has revolutionized the way people in India transact, making it easier and more convenient for everyone. Its popularity has led to an increase in digital payments and a decrease in the use of physical currency.

Highest ever UPI transactions

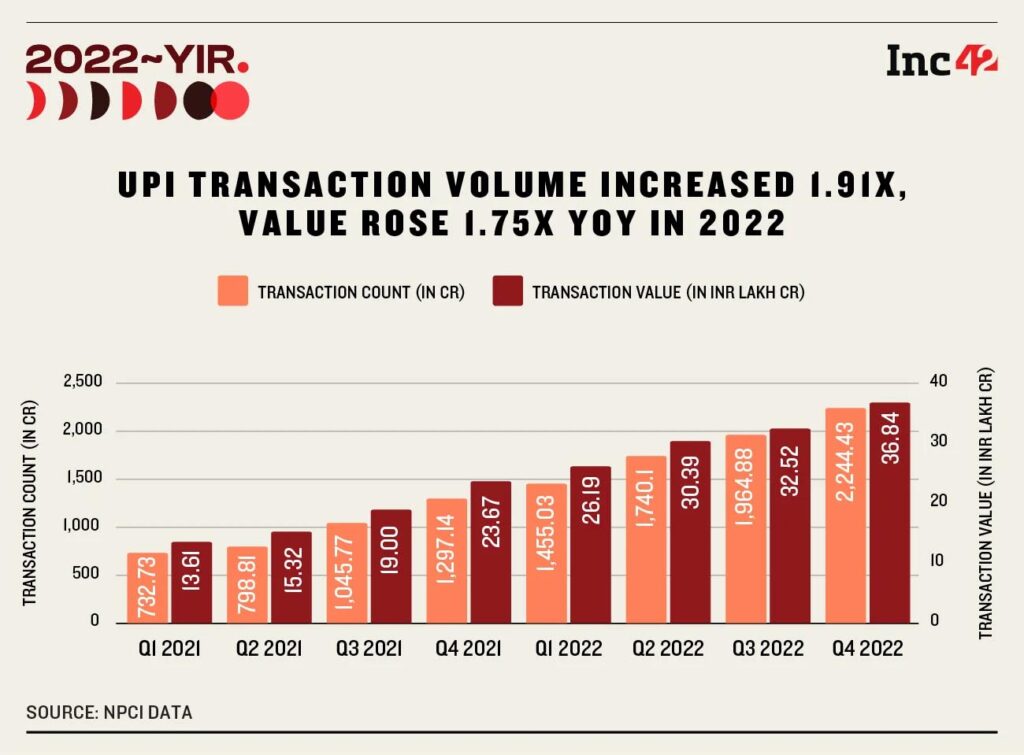

National Payments Corporation of India (NPCI) reports that the volume and value of UPI transactions increased by 60% and 46%, respectively, in March 2023 when compared to the same month in the previous year. UPI had handled 5.4 billion transactions totaling Rs 9.6 trillion by March 2022.

The number of UPI transactions was high in March 2023, which is due to several factors. Firstly, digital payments have become more popular as more people avoid direct contact to prevent the spread of the COVID-19 pandemic. Second, more people are using digital payment systems like UPI as a result of the Indian government’s efforts to promote a cashless economy.

This shift towards digital payments has not only made transactions more convenient and secure, but it has also helped to reduce the circulation of physical currency, which can be a source of infection transmission. Additionally, the adoption of digital payments has opened up new opportunities for financial inclusion, particularly for those who were previously excluded from traditional banking systems.

The success of UPI can also be related to its user interface, which makes it easy to use for users of all ages. Almost all Indians with bank accounts can use UPI, as more than 200 banks support the system. Additionally, UPI transactions are free, making them a desirable payment option for both individuals and small businesses.

As more Indians adopt digital payments, UPI is projected to gain popularity in the coming years. In fact, according to some experts, UPI may replace cash as the main form of payment in India in the next few years.

Finally, March 2023 marked a new high of 8.7 billion UPI transactions, demonstrating the growing acceptance of digital payments in India. UPI is well positioned to continue its growth trajectory and establish itself as the preferred payment method for millions of Indians owing to its user-friendly interface, widespread adoption and lack of transaction fees.