Friends, often in the field of stock market, mutual fund or business, we keep hearing the name of CAGR, like if a company has given a return of 10% CAGR in a year, then what is its real meaning?

Or what does it mean if a company’s EPS i.e. earnings per share has increased by 20% this time?

We often hear many such things about CAGR, but what is CAGR and how is it calculated, today we are going to know about it in some detail.

What is CAGR

In simple words, the meaning of CAGR is ‘Compounded Annually Interest’ meaning the annual compounded return on your invested capital is called CAGR.

Why is CAGR important?

CAGR is an essential tool for investors, as it provides a standardized way to compare the growth rates of various investments. It smooths out the volatility and fluctuations in annual returns, resulting in a more reliable figure. By using CAGR, investors can evaluate the performance and potential of different investments. It helps in making informed decisions by understanding the historical growth rate of an investment.

What does CAGR mean?

CAGR means the return you get on your money at the rate of compound interest.

That is, when your invested amount (money) increases at the rate of compound interest, then its interest rate is called the CAGR of that amount.

What is the full form of CAGR?

CAGR Full Form – Full form of CAGR is ‘Compounded Annual Growth Rate’

We hear the word CAGR again and again in share market, mutual funds or investing, but in such cases we do not know its real meaning.

Many times you must have heard that the stock market is growing at the rate of 20% CAGR, so what does it mean?

Or you might have heard that this year a company has given a profit of 10% CAGR, then what does it actually mean?

| Join Our Telegram Channel | Telegram Link |

| Join Our Telegram Channel | WhatsApp Channel |

Let us now know about it in some detail –

First of all, you should understand that whenever there is talk of return or growth of any company or share in the stock market, it is always calculated in CAGR.

Because the returns you get in the share market are always at the rate of compound interest, which we call ‘CAGR’ in short.

Meaning, if a company has given an average annual return of 20% to its investors in the last 20 years, then it means that the 20-year CAGR of that company is 20%.

Similarly, if a stock is growing at 10% growth rate every year, then we can say that the CAGR of that stock is 10%.

Now you must have understood that the average compound interest rate is what we call ‘CAGR’.

Example of CAGR

Suppose the profit of ABC Limited Company in 2010 was Rs 1000 crore, which increased to Rs 30000 crore in 2020,

So it will be said that the profit of ABC Limited Company has increased at a CAGR of 40.51% from 2010 to 2020 i.e. in 10 years.

Meaning ABC Limited Company has grown its profit at the rate of compound interest of 40.51% annually.

But now the question comes that how can we calculate CAGR, but before that let us know that –

When and where is CAGR used?

CAGR can be used for many purposes like-

In calculating the annual returns of mutual funds,

CAGR is used to find out the average percentage growth that a company’s share price has shown in the last few years.

To find out how fast a company’s revenue and profit are growing year after year,

In calculating interest on a liquid fund or death fund,

You can use CAGR to calculate the annual average return of interest rate of bank or FD.

And apart from this, there is a need to calculate CAGR in many works. How cougars calculate is explained further in this post.

How to calculate CAGR – How to calculate CAGR

How to calculate CAGR, for this you will have to use the CAGR formula for which you will need three things; Firstly, the investment amount that you have invested, secondly, the value of the final investment and thirdly, the time period for how many years you have invested.

Using these three things you can calculate CAGR.

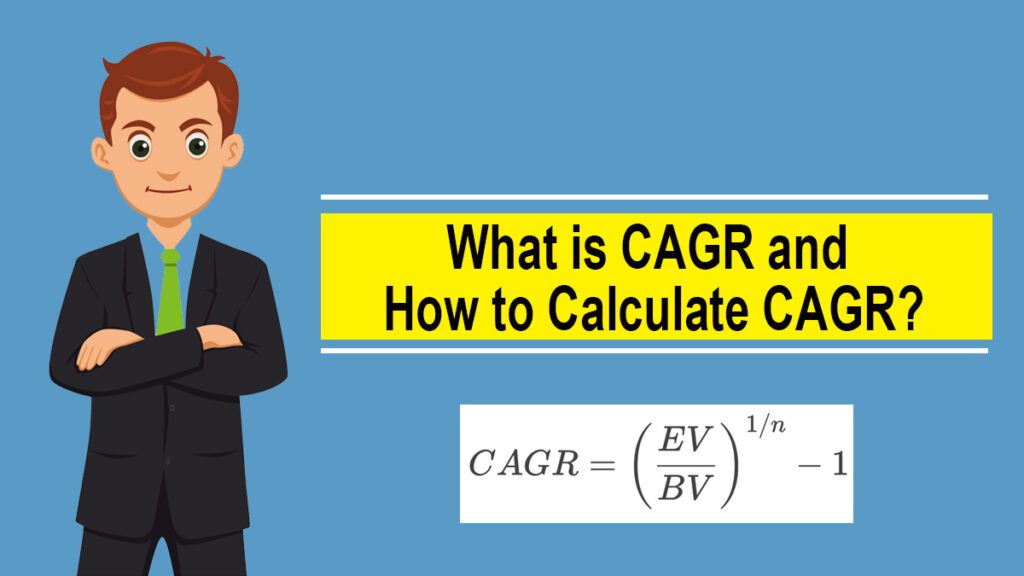

What is the formula of CAGR?

The formula for CAGR is given below;

- CAGR = (FV/SV)1/Year – 1

In this formula FV means final value i.e. the amount you get at the end of your investment.

SV means starting value i.e. the amount you invest initially.

And Year means that the number of years for which you have invested represents the time period.

Let us now know step by step how CAGR is calculated using this formula –

How to calculate CAGR?

To calculate CAGR, first enter the investment amount in the above formula.

After this enter the final value of your investment that you want to get at the end of the investment.

Then in this formula, in place of ‘Year’, enter the time duration (Years) for which you are investing.

For example;

Suppose you invested Rs 1000 in a mutual fund today, which increased to Rs 5000 after 5 years, meaning your money almost doubled in 5 years.

But now the question comes that what will be the average compounded return i.e. CAGR of these 5 years?

So to calculate CAGR, you put Rs 1000 in place of SV in the above formula (because this is the amount you are investing in starting).

After this, enter Rs 5000 (which is the final amount you will get) in FV.

And in place of ‘Year’ enter the number of years for which you are investing i.e. 5 years.

So your formula will look like this;

CAGR = (5000/1000)1/5 – 1

When you calculate using this formula, you will find that you have got an annual return of 37.97%.

That means you can say that if you invest Rs 1000 for 5 years and get Rs 5000 after 5 years, then your investment amount has increased by 37.97% CAGR.

Or you have got returns at the rate of 37.97% CAGR annually on your invested money.

I hope you now understand how to calculate CAGR.

What is CAGR calculator?

CAGR calculator is an online calculator with the help of which you can easily calculate CAGR Returns by just entering your investment amount, final value and time period.

Although you will find many CAGR calculators on the internet, but I find Groww’s CAGR calculator the best because its interface is very clean and there is no difficulty in using it and that is why I always use this calculator to calculate CAGR. Am.

What does 5% CAGR mean?

5% CAGR means that the money you invested has grown at an average interest rate of 5% compounded every year, meaning you have got an average return of 5% every year on your money.

Here it is not necessary that 5% CAGR is used only to calculate the value of your investment but it is also used to calculate the returns of a mutual fund, by what percentage the share price has increased every year. CAGR can be used to calculate the profit growth or returns of a company.