This comprehensive analysis give a guidence into the Rail Vikas Nigam Limited Share Price Target from 2024 to 2030, taking into account key financial metrics, market trends, and strategic initiatives. Rail Vikas Nigam Limited (RVNL) plays a pivotal role in enhancing India’s rail infrastructure, having been established by the Government of India in 2003. The company is involved in the execution of various rail infrastructure projects, including the construction of new lines, gauge conversion, and electrification. With the government’s continued focus on improving rail infrastructure, RVNL is positioned as a vital player in achieving these objectives.

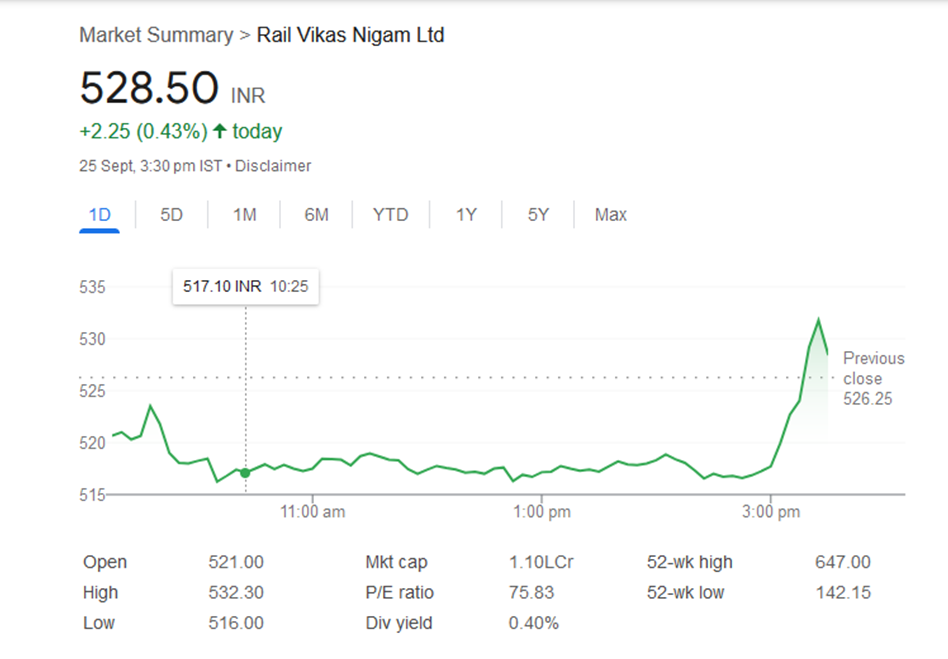

RVNL Share Price: Current Market Position

- Market Cap: ₹1.11 Crore

- Open: ₹521.00

- High: ₹532.50

- Low: ₹516.00

- P/E Ratio: 75.83

- Dividend Yield: 0.40%

- 52 Week High: ₹647.00

- 52 Week Low: ₹142.15

As of early 2024, RVNL’s share price reflects the company’s crucial role in the rail infrastructure sector and its strategic importance in national development initiatives. The company’s consistent project wins and execution capabilities have bolstered investor confidence.

Share Price in 2024: As of September 26, 2024, the share price of Rail Vikas Nigam Limited stands at ₹528.50. The stock has shown steady growth, driven by strong financial performance and positive growth prospects.

Rail Vikas Nigam Limited Share Price Recent Graph

Rail Vikas Nigam Limited Share Price Target (2024-2030)

| YEAR | SHARE PRICE TARGET |

| 2024 | ₹ 738.80 |

| 2025 | ₹ 918.21 |

| 2026 | ₹ 1,104.20 |

| 2027 | ₹ 1,302.77 |

| 2028 | ₹ 1,504.71 |

| 2029 | ₹ 1,690.88 |

| 2030 | ₹ 1,883.03 |

Read Also: ITC Share Price Target: Stock Broker Increases Target to ₹595!

Rail Vikas Nigam Limited Share Price: Short-Term Outlook (2024-2025)

The short-term forecast for Rail Vikas Nigam Limited’s share price encompasses several key factors:

Financial Performance: For FY2024, analysts expect RVNL to report revenues of approximately ₹20,000 crore, with a projected net profit margin of 5%. This translates to an estimated net profit of ₹1,000 crore, leading to an anticipated earnings per share (EPS) of ₹5. By the end of 2025, revenues are expected to rise to ₹23,000 crore, with a net profit margin of 5.5%, resulting in a net profit of ₹1,265 crore and an EPS of ₹6.32.

Market Sentiment: Positive investor sentiment is likely to be bolstered by the government’s ongoing focus on rail infrastructure development and RVNL’s strategic project wins. Public-private partnerships and increased budget allocations for rail infrastructure are crucial drivers of this sentiment.

Valuation Metrics: With a current P/E ratio of around 15x, the stock is expected to experience valuation expansion as profits increase. By the end of 2025, the P/E ratio may rise to 16x, reflecting enhanced investor confidence and the company’s growth trajectory.

Rail Vikas Nigam Limited Share Price: Mid-Term Projections (2026-2027)

In the mid-term, the share price target for Rail Vikas Nigam Limited will be influenced by continued growth and market dynamics:

Revenue Growth: The company aims to enhance its project execution capabilities by 10-12% annually. By FY2026, revenues are projected to reach ₹26,500 crore, with a sustained net profit margin of 6%, leading to an estimated net profit of ₹1,590 crore and an EPS of ₹7.95. By FY2027, revenues are expected to further increase to ₹30,500 crore, with a net profit margin of 6.5%, resulting in a net profit of ₹1,983 crore and an EPS of ₹9.91.

Profitability Metrics: Improved operational efficiencies and economies of scale are anticipated to enhance profitability. The gross profit margin is projected to increase from 12% in 2024 to 15% by 2026, contributing to higher net profits.

Valuation Trends: As the company demonstrates steady growth, the P/E ratio is likely to rise further. By FY2027, the P/E ratio could reach 18x, reflecting strong investor sentiment and market recognition of RVNL’s growth potential.

Rail Vikas Nigam Limited Share Price: Long-Term Prospects (2028-2030)

Long-term projections for Rail Vikas Nigam Limited’s share price are based on strategic execution and market trends:

Market Expansion: RVNL is expected to undertake large-scale projects in new regions, particularly in developing economies with high infrastructure demand. The company plans to diversify its project portfolio to include high-margin sectors such as urban rail and metro initiatives.

Technological Advancements: Investments in technology and innovation are critical for maintaining a competitive edge. RVNL aims to leverage advanced construction techniques and sustainable practices to enhance project performance and reduce costs.

Revenue and Profit Growth: By FY2030, revenues are projected to reach ₹46,000 crore, with a net profit margin of 8%. This translates to a net profit of ₹3,680 crore and an EPS of ₹18.4.

Valuation Metrics: With sustained growth and strategic initiatives, the P/E ratio could stabilize at 19x by 2030, reflecting strong investor confidence in the company’s long-term prospects.

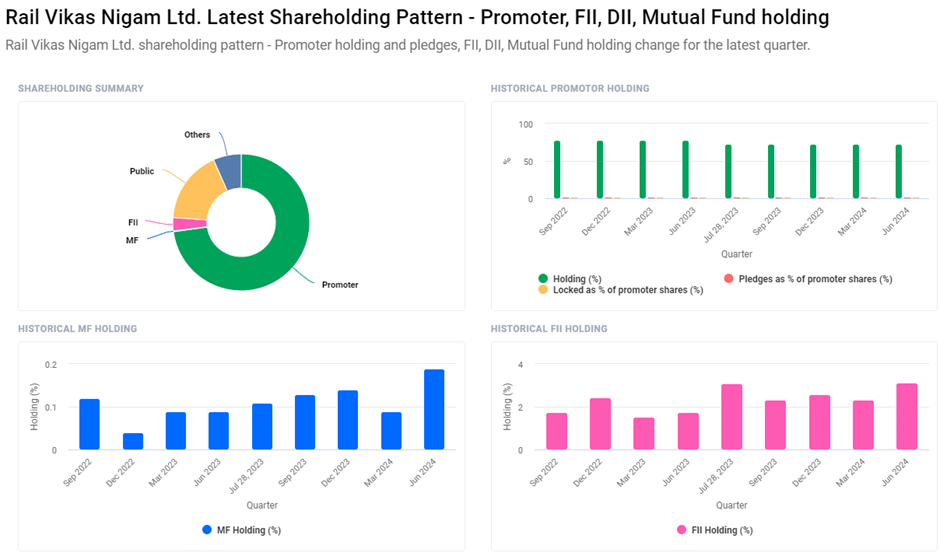

Investor Composition for Rail Vikas Nigam Limited Share Price

- Promoters: 72.84%

- Retail and Others: 17.26%

- Other Domestic Institutions: 6.58%

- Foreign Institutions: 3.13%

- Mutual Funds: 0.19%

Factors Influencing Rail Vikas Nigam Limited Share Price

Several key drivers impact the share price of Rail Vikas Nigam Limited (RVNL):

Economic Indicators: Both global and domestic economic conditions, including GDP growth, industrial output, and infrastructure spending, directly influence the demand for rail infrastructure services.

Government Policies: Government regulations and budget allocations related to rail infrastructure development, public-private partnerships, and urban development projects significantly affect RVNL’s project pipeline and revenue generation.

Raw Material Prices: Fluctuations in the costs of essential materials, such as steel and cement, driven by supply-demand dynamics and geopolitical factors, can substantially impact RVNL’s cost structure and profitability.

Technological Innovations: Advances in construction technology and sustainable practices can enhance project efficiency and reduce costs, directly influencing profitability.

Market Competition: The competitive landscape within the infrastructure sector affects market share and pricing strategies. RVNL’s ability to differentiate itself through quality, timely delivery, and customer service is crucial for maintaining its market position.

Strategic Initiatives for Rail Vikas Nigam Limited Share Price

To achieve projected growth and enhance its market position, Rail Vikas Nigam Limited is focusing on several strategic initiatives:

Project Diversification: Expanding into new segments, including urban rail projects, metro initiatives, and high-margin infrastructure projects.

Operational Efficiency: Implementing advanced project management strategies, lean manufacturing practices, and digital tools to improve overall project delivery and reduce costs.

Sustainability Focus: Prioritizing sustainable construction practices, green building certifications, and environmentally friendly project designs to comply with regulatory standards and market expectations.

Financial Prudence: Maintaining a healthy balance sheet by optimizing debt levels, enhancing working capital management, and ensuring timely project completions to improve cash flow.

Technological Investments: Investing in cutting-edge construction technologies, automation, and digital solutions to enhance project accuracy, overall performance, and sustainability.

Disclaimer: We advise exercising caution when making investment decisions based on the target prices presented on this website. These figures are speculative, and investing in the stock market carries inherent risks. The content provided here is intended solely for educational and informational purposes and should not be interpreted as financial advice or stock recommendations. Every investment carries the potential for both gains and losses, and no outcomes can be guaranteed. While we strive to ensure the accuracy of the information provided, we cannot be held responsible for any financial losses incurred from the use of this site’s data. It is crucial to conduct your own research before making any investment decisions.