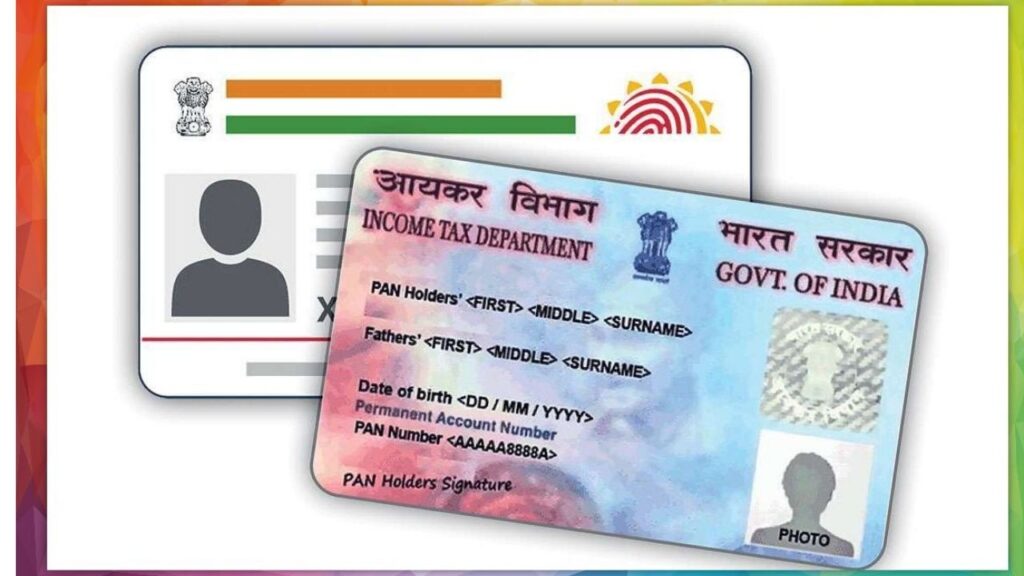

Pan Aadhar Link: Linking PAN card and Aadhaar card has become a mandatory requirement in today’s time. This process is not only necessary to comply with government rules but is also important for running your financial activities smoothly. Let’s learn about this topic in detail.

What is PAN Aadhar Link?

PAN Aadhaar link is a process in which your PAN card (Permanent Account Number) is linked to your Aadhaar card. It is an initiative started by the government, which aims to bring transparency in financial transactions and prevent tax evasion.

Why is PAN-Aadhaar linking necessary?

1. Legal requirement: The government has made it mandatory.

2. Convenience in financial transactions: Essential for banking and other financial services.

3. Prevention of tax evasion: Helps the government to keep an eye on the financial activities of individuals.

4. Avoid penalty: Failure to do the linking on time can lead to a hefty penalty.

Who are exempted?

Certain categories of people are exempted from PAN-Aadhaar linking:

1. Non-resident Indians (NRIs)

2. Senior citizens aged 80 years and above

3. Foreign nationals

How to do PAN-Aadhaar linking?

It is a simple online process:

1. Visit the official website of Income Tax.

2. Select the “Link Aadhaar” option.

3. Enter your PAN and Aadhaar number.

4. Check the information.

5. Pay a fee of Rs 1000.

6. Get confirmation.

Deadline and penalty

The original deadline for PAN Aadhaar link has expired. Now, an additional fee of Rs 1000 will have to be paid to complete this process. If you do not do it, a penalty of up to Rs 10,000 can be imposed.

Consequences of not linking

If you do not done PAN Aadhaar link, you may face the following problems:

1. Your PAN card may become invalid.

2. You will not be able to use banking services.

3. You may be fined heavily.

4. You will not be able to file income tax returns.

5. You will not be able to open new bank accounts.

Importance of PAN-Aadhaar Linking

PAN-Aadhaar linking is not only a legal requirement, but it is also an important step to make your financial life secure and well-organized. It helps in running your financial activities smoothly and saves you from many potential hassles.

By completing this process, you not only comply with legal obligations but also ensure your financial security. This step helps in bringing financial transparency and preventing tax evasion, which is also important for the country’s economy.

If you have not linked your PAN and Aadhaar yet, then this is the right time to do it. It is a simple process that can save you from many hassles. Remember, delaying can cost you a hefty penalty and affect your financial activities.

Understand your responsibility and complete this process as soon as possible. If you face any problem, contact the Income Tax Department helpline or your nearest Income Tax office. They are ready to help you.

PAN-Aadhaar linking is a small step that plays a big role in making your financial life secure and well-organized. So, prioritize this important task and secure your financial future.