In today’s digital age, where almost everything is available at the touch of a button, it is important to prioritize the security of our personal information, especially when it comes to our finances. One of the most important aspects of securing our banking transactions is the strong and secure ATM PIN online. State Bank of India (SBI) understands its importance and provides its customers the facility to generate their ATM PIN online. In this article, we will guide you through the step-by-step process of generating your SBI ATM PIN online, ensuring a seamless and secure experience.

Before starting the ATM PIN generation process, make sure you have the following information available:

SBI Account Number: This can be found on your bank statement or passbook.

Debit Card Details: You will need the 16 digit card number, expiry date and CVV (Card Verification Value) printed on the back of your debit card.

Internet Banking Access

To generate your SBI ATM PIN online, you must have active internet banking access. Make sure that you have activated internet banking for your SBI account and you have an active mobile number registered with the bank.

To start the process, visit the SBI online banking portal. You can do this by typing the URL or using the direct link provided by the bank.

Once you reach the SBI Online Banking portal, enter your username and password to log in to your account.

After logging in, go to the ATM Services section. You can usually find this option under the menu for managing your ATM card services.

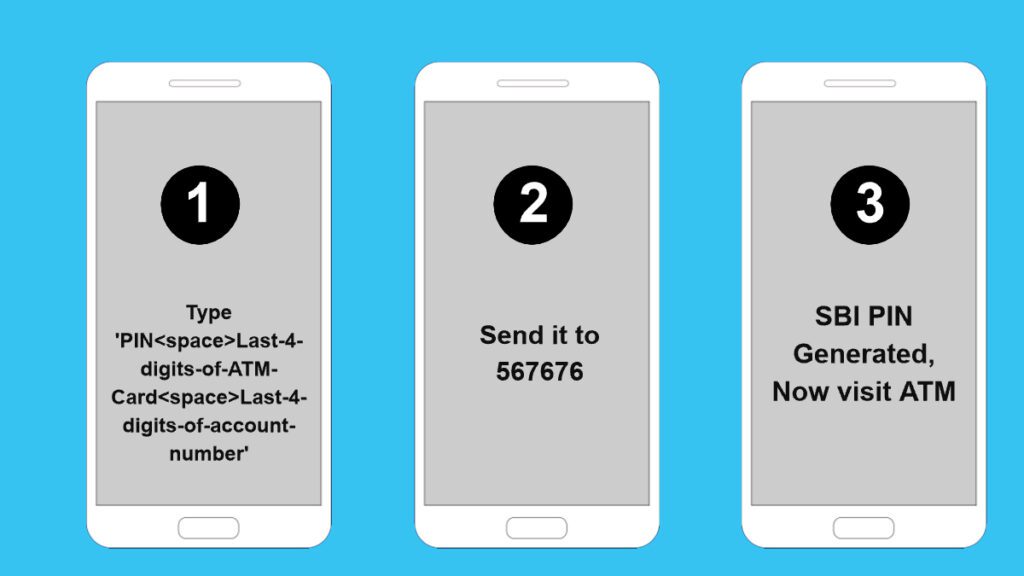

ATM Pin Online Generation Process

Within the ATM Card Services section, locate the specific option to create a new ATM PIN. Click on it to start the process.

Next, you need to enter the required debit card details including 16 digit card number, expiry date and CVV. Double check the information you entered for accuracy.

For security purposes, SBI requires you to generate a one-time password (OTP) to verify your identity. You can choose to receive the OTP via SMS or email.

Once you receive the OTP, enter it in the specified field to complete the verification process.

Before proceeding, review all the details you entered to ensure accuracy. Once confirmed, proceed to the next step.

When setting your new ATM PIN, it is important to choose a secure and unique combination. Avoid using easily guessable numbers like dates of birth or consecutive sequences. Instead, choose a mix of numbers that are easy for you to remember but difficult for others to guess.

Choose the option to enter a new PIN and modify the default PIN provided by the bank. Follow the guidelines given by the bank to create a secure PIN.

Retype the newly chosen PIN to confirm and make sure you entered it correctly.

Successful Pin Generation

If all the steps are completed successfully, you will receive a confirmation message or notification stating that your ATM PIN has been successfully generated.

After generating your new ATM PIN, it is necessary to log out of your Internet Banking session for security purposes. Sign out properly to ensure that your account remains secure.

To ensure that your new ATM PIN is working correctly, visit an SBI ATM and try to conduct a transaction using the newly generated PIN.

Also Read: How to find your ATM number if you lose your ATM card?

Conclusion

A secure ATM PIN is extremely important to protect your financial transactions from unauthorized access. By availing SBI’s online ATM PIN generation service, you can easily and securely generate your ATM PIN from the comfort of your home. Remember to follow the steps mentioned in this article to ensure a smooth and secure experience. The security of your financial transactions should be a top priority, and with SBI, you can do so with ease and convenience. So, why wait? Generate your SBI ATM PIN online today and enjoy peace of mind in all your banking transactions.