Are you looking for a hassle-free and convenient way to manage your finances? Look no further than Jupiter Bank Account! In this article, we will explore all the details about Jupiter bank account, including the highlights, benefits, eligibility criteria, documents required, interest rates, charges, and much more. So let’s dive in and discover why Jupiter Bank is the perfect choice for your financial needs.

1. What is Jupiter Bank Account?

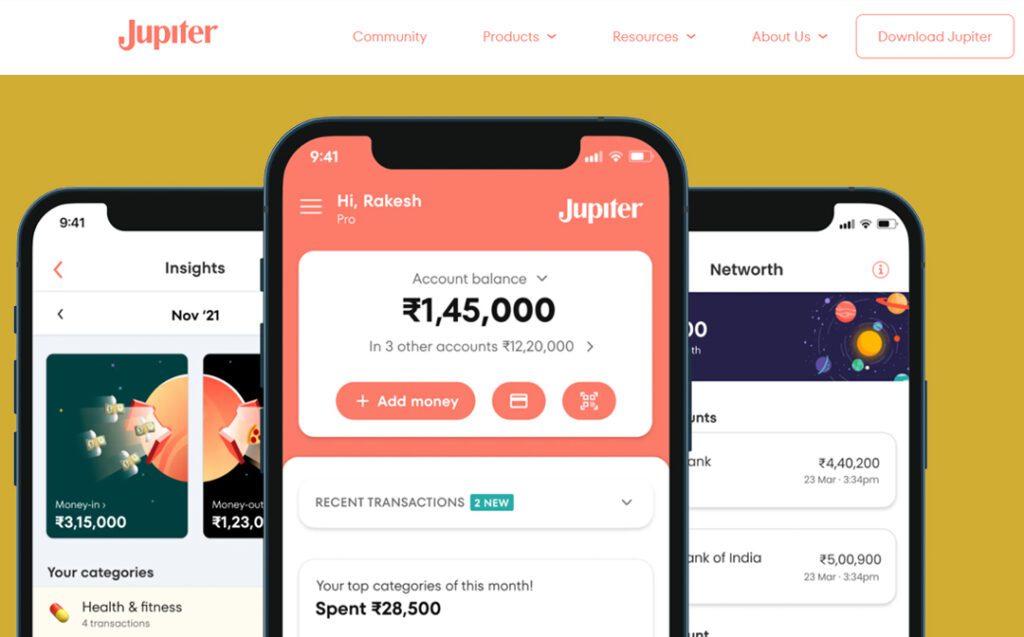

Jupiter Bank is a leading digital banking platform that provides seamless and user-friendly banking services. It offers a range of products and services, including savings accounts, salary accounts, debit cards, and actionable insights to help you make informed financial decisions.

2. Highlights of Jupiter Digital Account

Convenient and secure digital banking experience

Instant account opening process

User-friendly interface and intuitive mobile app

Access to actionable insights for better financial management

Competitive interest rates on savings accounts

Free digital transactions and reduced charges for branch transactions

3. More Information About Jupiter

| Jupiter App Founder | Jitendra Gupta is the founder and CEO of Jupiter. |

| Operator of Jupiter | Amica Financial Technologies Pvt. Ltd. |

| Jupiter Bank App | Jupiter App Download |

| Jupiter Bank Login | Click Here for Jupiter login |

| Jupiter Bank Net-Banking | Click Here for Jupiter Net banking |

| Google Play Store Rating | 4.4 Star ratings with more than 324K reviews |

| Downloads on Google Play Store | 5 Million plus downloads on the Google Play Store |

Jupiter Bank is a tech-driven bank that aims to revolutionize the banking industry with its cutting-edge digital solutions. It is backed by a team of experienced professionals and technologists who are committed to providing the best-in-class banking experience to their customers.

4. Jupiter Account Benefits

Opening a Jupiter Bank account comes with a wide range of benefits. Here are some key advantages:

High interest rates: Jupiter offers competitive interest rates on its savings accounts, ensuring that your money grows steadily.

Digital banking convenience: With Jupiter, you can perform all your banking transactions conveniently through their user-friendly mobile app.

Actionable insights: Jupiter provides valuable insights into your spending patterns, mutual fund performance, net worth, and digital pots, empowering you to make informed financial decisions.

Zero or reduced charges: Jupiter offers free digital transactions and significantly reduced charges for branch transactions, saving you money on banking fees.

5. Eligibility for Saving Account in Jupiter

To open a savings account with Jupiter Bank, you need to meet the following eligibility criteria:

Resident Indian individual

Minimum age of 18 years

Have a valid proof of identity and address documents

6. Documents Required for Jupiter Account Opening

To open a Jupiter Bank account, you will need to submit the following documents:

- Proof of identity: Aadhaar card, PAN card, passport, or driving license

- Proof of address: Aadhaar card, passport, utility bill, or rent agreement

- Passport size photographs

- Income proof (optional)

7. Jupiter Bank Interest Rate

Jupiter Bank offers competitive interest rates on its savings accounts. The interest rate varies based on the account balance and the bank’s discretion.

| Balance | Jupiter Savings Account Interest Rate (p.a.) |

| Less than ₹5 Lakhs | 3.05% p.a. |

| ₹5 Lakhs to ₹50 Lakhs | 3.10% p.a. |

| ₹50 Lakhs to ₹5 Crore | 3.75% p.a. |

| ₹5 Crore to ₹50 Crore | 4% p.a. |

| Greater Than ₹50 Crore | 6% p.a. |

8. Jupiter Bank Charges

8.1 Digital Payments and Transactions Charges

Jupiter Bank provides free digital transactions for its customers. However, certain charges may apply for specific services such as NEFT, RTGS, or other fund transfers. It is advisable to refer to the bank’s official website for detailed information on charges.

| Online Payments – NEFT/RTGS/UPI | No charges |

| Online Payments – IMPS | No charges for the first 5 transactions |

8.2 Branch Transactions and Other Charges

Jupiter Bank offers reduced charges for branch transactions compared to traditional banks. The charges for services like cash deposit, withdrawal, checkbook issuance, and demand drafts can be found on the bank’s website.

9. Jupiter Bank Review

Jupiter Bank has received positive reviews from its customers for its seamless user experience, exceptional customer service, and competitive interest rates. Users have praised its mobile app’s efficiency and simplicity, making banking tasks hassle-free.

10. Jupiter Bank Account Opening Online Process

Opening a Jupiter Bank account is a quick and simple process. You can follow these steps to open an account online:

Download the Jupiter Bank mobile app from the App Store or Google Play Store.

Sign up using your mobile number and email address.

Complete the KYC requirements by uploading your ID and address proofs.

Fill in the required details and submit the application.

Once your application is approved, your digital account will be activated, and you can start using it immediately.

11. How to Close Jupiter Bank Account

If you wish to close your Jupiter Bank account, you can do so by following these steps:

Contact Jupiter Bank’s customer care or visit the nearest branch to initiate the account closure process.

Provide the necessary details and documents as requested by the bank.

Clear any pending dues or charges, if applicable.

Once the account closure request is processed, your account will be closed, and any remaining balance will be transferred to your linked bank account.

Read More : How to Close Jupiter Bank Account

12. Jupiter Bank Customer Care Number

For any queries or assistance, you can reach out to Jupiter Bank’s customer care through the following contact numbers:

12.1 For Jupiter’s Customers

Customer-related queries will be solved by the following two methods.

- Jupiter Account Customer Care Number: 086 550 550 86

- Jupiter Money Email ID: support@jupiter.money

12.2 For Jupiter’s Non-Customers

If have some media inquiries, kindly contact the email id mentioned below.

- Jupiter Money Email Id: contact@jupiter.money

12.3 For Early Adopters

If you have a question or arrange a meeting with Jupiter, use the email address listed below.

- Jupiter Money Email Id: community@jupiter.money

12.4 Federal Bank Customer Care Number

If you want also know Jupiter Federal Bank Customer Care Number.

- Federal Bank Customer Care Number: 1800 425 1199

- Federal Bank Customer Care: 1800 420 1199

- Federal Bank Email Id: contact@federalbank.co.in

12.5 For Mutual Fund Consultation

If you want inputs from Jupiter on your Mutual Fund Investment, email them at investments@jupiter.money.

13. Jupiter Bank Grievance Redressal Mechanism

Jupiter Bank has a well-defined grievance redressal mechanism to address customer complaints and queries. The process is divided into three levels:

13.1 Grievance Redressal at Level 1

If you have any complaints or grievances, you can reach out to Jupiter Bank’s customer care helpline mentioned above. They will try to resolve the issue promptly.

- Official App: Click Here to Download Jupiter App

- Jupiter Customer Care Number: 086 550 550 86

- You can contact Jupiter Helpline Number from 9 am to 9 pm except on public holidays.

- Jupiter Email Id: support@jupiter.money

- Address: You can write a letter to Jupiter Customer Care through the address mentioned below.

Customer Service Department

Amica Financial Technologies Private Limited

Address: 2nd floor, Hello World Building,

5th Main, Sector 7, HSR Layout, Bengaluru,

Karnataka 560102

13.2 Grievance Redressal at Level 2

If your grievance is not resolved at the first level, you can escalate it to the nodal officer. Contact details of the nodal officer can be found on Jupiter Bank’s official website.

Rajesh Singh

Grievance Redressal Officer (GRO)

Amica Financial Technologies Private Limited

Address: 2nd floor, Hello World Building,

5th Main, Sector 7, HSR Layout, Bengaluru,

Karnataka 560102

Email: grievance@jupiter.money

13.3 Grievance Redressal at Level 3

If your complaint is still not resolved, you can approach the banking ombudsman appointed by the RBI. The contact details of the banking ombudsman can be found on the RBI’s official website.

You can send a letter to Jupiter’s Noda Officer at the following address.

Nikhil Godbole

Nodal Officer

Amica Financial Technologies Private Limited

Address: 2nd floor, Hello World Building,

5th Main, Sector 7, HSR Layout, Bengaluru,

Karnataka 560102

Email: nodalofficer@jupiter.money

Customers may file a complaint to the RBI Ombudsman if they are not satisfied with the response provided at Level 3 or if they don’t receive a reply within 1 month after the submission of the complaint.

You can send a letter to RBI Ombudsman at the following address.

C/o Reserve Bank of India RBI

Byculla Office Building

Opp. Mumbai Central Railway Station

Byculla, Mumbai-400 008

Telephone No: 022 2300 1280

Fax No: 022 2302 2024

14. Jupiter Salary Account

Jupiter Bank also offers specialized salary accounts tailored to meet the needs of working professionals. Let’s explore the benefits, eligibility, documents required, and how to open a Jupiter salary account.

14.1 Benefits of Jupiter Salary Account

- High-interest rates on savings

- Instant salary credit

- Special offers and discounts

- Convenient salary withdrawals and payments

- Free digital transactions

14.2 Jupiter Salary Account Eligibility

To open a Jupiter Salary Account, you need to fulfill the following eligibility criteria:

Employed in a registered company or organization

Minimum age of 18 years

14.3 Documents Required for Jupiter Salary Account

The documents required to open a Jupiter Salary Account include:

Proof of identity and address

Employee ID card or letter from the employer

14.4 How to Open Jupiter Salary Account

You can open a Jupiter Salary Account by following these steps:

Download the Jupiter Bank mobile app.

Sign up using your mobile number and email address.

Complete the KYC requirements by uploading your ID and address proofs.

Select the “Open Salary Account” option and provide the necessary details.

Submit the application, and upon approval, your salary account will be activated.

14.5 Compare Jupiter Salary Account with Other Bank’s Salary Account

Jupiter Salary Account offers several advantages compared to traditional bank salary accounts. It provides higher interest rates, free digital transactions, and a range of additional benefits that enhance the overall banking experience.

15. Jupiter On Demand Salary

Jupiter Bank understands that financial emergencies can occur at any time. With Jupiter On Demand Salary, you can access your salary in advance whenever you need it. This feature offers financial flexibility and helps you manage unexpected expenses without any hassle.

16. Jupiter Card or Jupiter Debit Card

Jupiter Bank provides a Jupiter Card, which is a debit card linked to your account. You can use this card for cash withdrawals, making purchases, and online transactions.

17. Jupiter Card Charges and ATM Charges

Jupiter Bank offers transparent and minimal charges for its Jupiter Card and ATM usage. The specific charges can be found on the bank’s official website.

| If You Order a Jupiter Debit Card for the First Time | Rs.299 |

| Jupiter Money Debit Card Replacement Fee | Rs.299 |

| Jupiter Card Annual Charges | NIL |

| Jupiter Debit Card Transaction Fee at ATM | NIL (if you use Federal Bank ATMs) |

| Transaction Fee (other than Federal Bank ATMs) | Free for first 5 transactions per month |

| After 5 transactions, ₹21 for cash withdrawal & ₹11 for balance check or mini statement per transaction | |

| Cash Withdrawal Outside India | ₹100 per cash withdrawal + 3.5% Forex Charges on all international ATM withdrawals |

| Balance Check or Mini Statement from any ATM Outside India | ₹25 per inquiry |

| Transaction Decline Fee at ATM due to Insufficient Funds | For Domestic Transactions: |

| No charges at Federal Bank ATMs | |

| Rs.25 at any other ATM | |

| For International Transactions: | |

| Rs.100 per transaction | |

| Transaction Decline Fee | No charges for the first two transactions, thereafter Rs.100 per transaction |

18. Jupiter Actionable Insights

Jupiter Bank provides valuable actionable insights to its customers, enabling them to make informed financial decisions. Here are some key insights offered by Jupiter:

18.1 Monthly Spend Breakdown

Jupiter provides a detailed breakdown of your monthly expenses, categorized into various spending categories. This helps you monitor your spending habits and identify areas where you can save.

18.2 Mutual Fund Performance

Jupiter offers insights into your mutual fund investments, allowing you to track their performance and make necessary adjustments if required.

18.3 Net Worth

Jupiter provides you with an overview of your net worth, including your assets and liabilities. This helps you monitor your financial health and plan for the future.

18.4 Digital Pots

Jupiter allows you to create digital pots to save money for specific goals or expenses. You can set up automated transfers to these pots and track your progress towards achieving your financial targets.

19. Conclusion

Jupiter Bank offers a revolutionary digital banking experience that simplifies your financial management. With its seamless account opening process, competitive interest rates, low charges, and actionable insights, Jupiter Bank is indeed a game-changer in the banking industry.

20. Jupiter Money FAQs

What is the minimum balance required to maintain a Jupiter Bank account?

Jupiter Bank does not require a minimum balance to maintain a savings account.

Can I open a Jupiter Salary Account if I am self-employed?

No, Jupiter Salary Account is only available to employees of registered companies or organizations.

Does Jupiter Bank charge for ATM withdrawals?

Jupiter Bank offers minimal charges for ATM withdrawals, which can be found on their official website.

Can I access my Jupiter Salary Account through other bank’s ATMs?

Yes, you can withdraw money from your Jupiter Salary Account through any ATM that accepts Visa or Mastercard.

How secure is the Jupiter Bank mobile app?

Jupiter Bank ensures the highest level of security for its mobile app, including multiple layers of authentication and encryption.

Can I link my Jupiter Card to multiple bank accounts?

No, Jupiter Card can only be linked to your Jupiter Bank account.

Can I set spending limits on my Jupiter Card?

Yes, Jupiter Bank provides spending limit customization options to ensure better control over your expenses.

In conclusion, Jupiter Bank offers innovative banking solutions that cater to your specific financial needs. Whether it’s opening a savings account, availing a salary account, or accessing actionable insights, Jupiter Bank provides a seamless and convenient experience. With its user-friendly interface and exceptional customer service, Jupiter Bank is leading the way in the digital banking era.