Life insurance is an arrangement between an insurance company/government that guarantees compensation for loss of life in return for payment of a specified premium. In life insurance, the beneficiary named in the contract receives a certain amount from the insurer on the occurrence of an event.

Insurance is important for families so that they feel a sense of security and confidence to continue with their lives without losing their daily stability. To help you understand the key features and benefits of life insurance

Features of Life Insurance Plans

- Policyholder

The policyholder is the person who pays the premium for the life insurance policy and signs the life insurance contract with the life insurance company.

- Premium

Premium is the cost that the policyholder pays to the life insurance company to cover his life.

- Maturity

Maturity is the stage at which the policy term is completed and the life insurance contract ends.

- Insurance

An insured is a person whose life is protected by life insurance. After his/her death the insurance company is responsible for providing the monetary amount to the dependents.

- Sum Assured

The amount that the insurance company pays to the insured’s dependents if the events specified in the life insurance contract occur.

- Policy Term

The policy term is the specified period (listed in the insurance contract) for which the insurance company provides life cover and the period during which the contract is active (listed in the life insurance contract).

- Nominees

A nominee is a person listed in a insurance contract who is entitled to a predetermined benefit as part of the policy.

- Claim

On the death of the insured, the nominee can file a claim with the insurance provider to get the predetermined payout amount.

Benefits of life insurance

Risk Coverage: Insurance provides risk coverage to the insured family in the form of monetary compensation in lieu of the premium paid.

Different plans for different uses: Insurance companies offer different types of plans to the insured depending on his insurance needs. With higher premiums come higher benefits.

Cover for health expenses: These policies also cover hospitalization and treatment expenses for critical illness.

Encourages savings/helps in wealth creation: Insurance policies also come with a savings plan, ie it invests your money in profitable ventures.

Guaranteed Income: An insurance policy comes with a guaranteed sum assured that is payable on the occurrence of an event.

Loan facility: Insurance companies provide an option to the insured that they can borrow a fixed amount. This option is available only on selected policies.

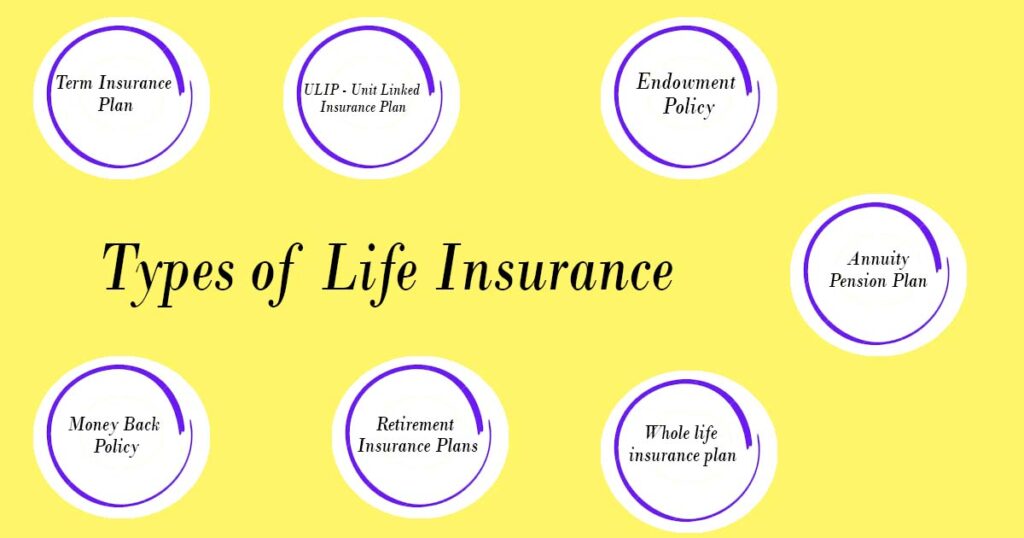

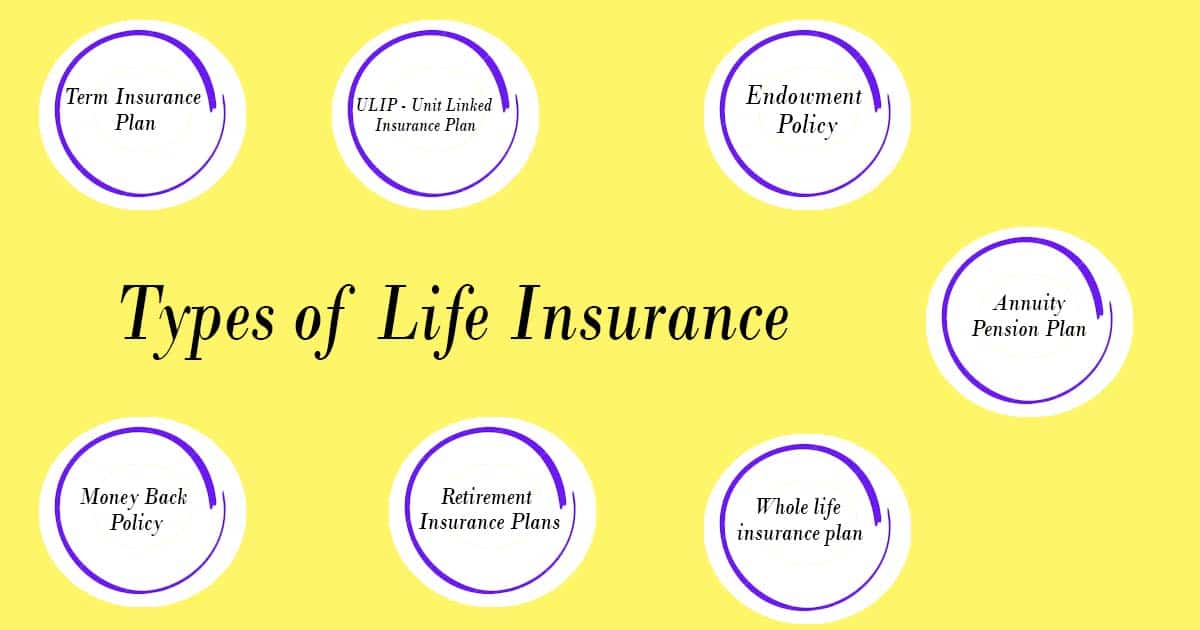

Types of Life Insurance Policies

Term Insurance Plan

Term insurance protects your family’s financial future if something happens to you. Designed as a simple and cost-effective way to provide financial security, term plans are an important part of financial planning for the primary wage earner in the family.

Term insurance is a pure protection plan and is not market linked. Also, the premium for term insurance is less as compared to any other life insurance product. The premium is also cheaper if you buy it early in life. Experts often recommend that a term plan should be your priority as soon as you start earning.

Term insurance can be used for a variety of purposes. In the absence of income, your family can use the insurance cover to pay for living expenses, education expenses or marriage expenses. If you have any outstanding loans like home loan, car loan etc., your family can pay the same with the cover.

ULIP – Unit Linked Insurance Plan

Unit Linked Insurance Plan (ULIP) is a combination of insurance and investment. ULIPs provide life cover that provides financial security to your loved ones. Apart from this, it also gives you the possibility of creating wealth through market related returns from systematic investments.

ULIP gives you an opportunity to invest your money in various fund options depending on your risk appetite. ULIPs come with a lock-in period of 5 years, and the money can be invested in bonds, equities, hybrid funds, etc. If you are looking for safer options, then bonds can be a good option. On the other hand, if you are ready to take more risk, hybrid funds and equity have the potential to deliver better returns.

Since everyone is different, ULIPs offer a lot of flexibility when it comes to investing. Your risk appetite and investment preferences may change with age. ULIPs allow you to consider these factors and change your investment strategy accordingly.

Endowment Policy

The only difference between a term insurance plan and an endowment policy is that an endowment policy comes with an added benefit that the policyholder will receive a lump sum amount if he survives till the maturity date. Rest of the details of term policy are same and applicable to endowment policy as well.

Like ULIPs, endowment plans are also quite flexible. You can choose the suitable method and time limit for paying the premium. Endowment plans also give you an opportunity to get a bonus, which is paid over and above the sum assured of your policy.

Money Back Policy

This policy is similar to an endowment policy, the only difference is that this policy offers multiple survival benefits which are allocated in proportion to the policy term.

Money back plan is a life insurance policy in which the insured receives a percentage of the sum assured at fixed intervals. Since you save regularly, money back plans reward you regularly. In simple words, Money Back Plan is an endowment plan that has the benefit of increased liquidity with regular payouts. Money back plans are designed to help you meet your short term financial goals. Money back facility can increase your monthly or annual income.

Whole life insurance plan

Unlike other policies that expire at the end of a specified term, this policy extends to the entire life of the life assured. The policy also provides survival benefits to the insured. In this type of policy, the policyholder has the option to partially withdraw the sum assured. The policyholder also has the option of borrowing money against the policy. The longer coverage period of such plans ensures protection for your family for an extended period of time.

Whole life insurance is ideal for those who are financially dependent even in their old age. The biggest advantage of this product is that it not only provides lifelong protection to the life assured but also provides an easy way to leave a legacy for your children.

Retirement Insurance Plans

Retirement plans are designed to help you build an adequate corpus for your post-retirement days. They help you achieve financial independence in your non-working years. A retirement plan allows you to save and invest for the long term, providing significant opportunities for wealth accumulation. Since retirement plans offer insurance benefits, you can also ensure financial security for your loved ones by investing in these plans.

Annuity/Pension Plan

Under this policy, the amount collected as premium is accumulated as an asset and distributed to the policyholder as income through annuity or lump sum amount depending on the policyholder’s instructions.

Points to Consider for Life Insurance

Read the terms and conditions: The terms and conditions of an insurance plan contain all the relevant information about a particular policy. Make sure you read and fully understand the insurance policy of your choice before purchasing it.

Remember the lock-in period: There are cases when individuals buy an insurance policy without making an informed decision and later they find out that they are unhappy with the insurance policy. In such circumstances, some insurance companies offer a lock-in period, usually as long as 15 days where the policyholder can return the policy to the insurer and buy another if they are unsatisfied with the initial purchase.

Research: As an applicant for life insurance, you have several policy options at your fingertips to choose from. It is essential that you do your research before making an informed decision about buying a life insurance policy, as it can help you save money and reap maximum benefits.

Consider premium payment options: Almost all insurance providers offer premium payment options on an annual, half-yearly, quarterly or monthly basis. It is necessary that you opt for Electronic Check System (ECS) payment, which will be debited from your bank account along with the required insurance amount from time to time. Also, you can choose from a schedule that will allow you to make premium payments with the convenience of interval payments.

Do not hide information: There are times when people try to hide information while filling the insurance application form. All personal credentials and medical history must be submitted accurately to the insurance company. Incorrect information can cause serious problems when trying to claim later.

Some of Major Life Insurance Companies in India

- LIC – Life Insurance Corporation of India

- SBI Life Insurance

- ICICI Prudential Life Insurance

- HDFC Standard Life Insurance

- Bajaj Allianz Life Insurance

- Max Life Insurance

- Birla Sun Life Insurance

- Kotak Life Insurance