A Loan Eligibility Calculator is a simple yet powerful online tool that helps individuals determine their eligibility for various types of loans based on their income, expenses, and existing debts. By inputting these key financial details, users can quickly estimate the amount they might qualify for, making it easier to plan their financial future.

Why Use a Loan Eligibility Calculator?

- Saves Time: Instead of going through complex calculations or contacting lenders for quotes, a calculator provides immediate results.

- Informed Decisions: By knowing your eligibility, you can make informed decisions regarding your loan options and avoid taking on more debt than you can handle.

- Budget Planning: Understanding how much you can borrow helps in creating a realistic budget for your monthly payments and overall financial planning.

- Prepares for Lender Requirements: Knowing your eligibility can prepare you for what lenders will look for, allowing you to gather necessary documentation in advance.

Loan Eligibility Calculator

How Does a Loan Eligibility Calculator Work?

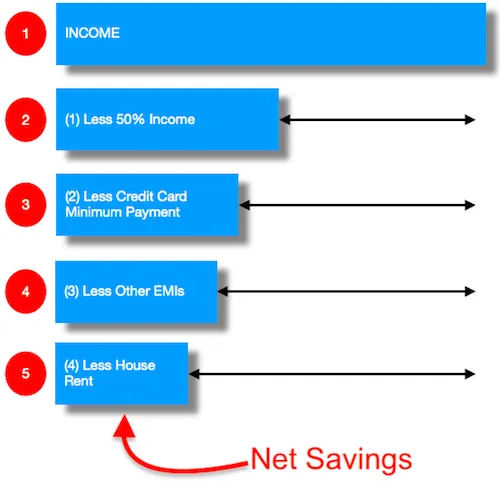

Typically, a Loan Eligibility Calculator considers the following factors:

- Monthly Income: Your total income before deductions (including salary, bonuses, rental income, etc.).

- Monthly Expenses: This includes your regular expenses like rent, groceries, utilities, and any other recurring costs.

- Existing Loan Obligations: Any ongoing loan payments (e.g., personal loans, auto loans, or credit card repayments).

Example Calculation

Let’s say you earn ₹50,000 per month, have monthly expenses of ₹20,000, and are currently paying ₹10,000 towards existing loans. Here’s how you might use the calculator:

- Disposable Income: ₹50,000 (Income) – ₹20,000 (Expenses) – ₹10,000 (Existing Loans) = ₹20,000

- Loan Eligibility Estimate: Assuming that 50% of your disposable income can be allocated to a new loan repayment, your estimated loan eligibility would be:

- ₹20,000 (Disposable Income) x 50% = ₹10,000

- ₹10,000 x 12 (for annual eligibility) = ₹1,20,000

In this example, you might be eligible for a loan of approximately ₹1,20,000, depending on other lender criteria.

Tips for Using a Loan Eligibility Calculator Effectively

- Be Honest: Enter accurate and realistic figures for your income and expenses to get a more accurate result.

- Consider Future Changes: Think about any potential changes in your financial situation, such as salary increases or planned expenses, that could affect your eligibility.

- Use Multiple Calculators: Different lenders may have varying eligibility criteria. Using multiple calculators can provide a broader view of your potential eligibility.

- Check for Hidden Costs: Remember that loan eligibility is just one part of the equation. Be aware of interest rates, processing fees, and other costs that may affect your repayment capacity.